IGNITE

INVESTING ACADEMY

I’M OBSESSED WITH HELPING WOMEN BECOME MILLIONAIRES.

ARE YOU READY TO TAKE YOUR FINANCES TO THE NEXT LEVEL?

IS YOUR MONEY WORKING AS HARD AS POSSIBLE FOR YOU?

READY TO HAVE COMPLETE FINANCIAL CONFIDENCE ?

IGNITE

$

IGNITE $

YOU HAVE A VISION TO CREATE:

FINANCIAL INDEPENDENCE

FREEDOM

ABUNDANCE

TIME

LUXURY

AFTER SUPPORTING HUNDREDS OF WOMEN IN ACHIEVING THEIR GOALS THE PAST SIX YEARS, I’M EXCITED TO BE OFFERING A PROGRAM TO HELP YOU UNDERSTAND EVERY PIECE OF YOUR FINANCES, MAKE YOUR MONEY WORK HARDER FOR YOU, FEEL CONFIDENT, AND REACH FINANCIAL INDEPENDENCE!

LET’S WORK TO BUILD YOUR VISION OF WEALTH & FINANCIAL FREEDOM

LET’S GET INTO THE DETAILS…PROGRAM PILLARS:

1

CRAFT A VISION FOR YOUR FINANCIAL FUTURE. WHAT ARE YOU BUILDING? WHAT ARE YOU WORKING TOWARD? WHY? WHO ARE YOU BUILDING IT FOR?

2

ANALYZE AND OPTIMIZE YOUR SPENDING PLAN - WHAT % IS GOING TO NEEDS, WANTS, SAVINGS, INVESTMENTS, & GOALS. UNDERSTAND HOW TO PRIORITIZE WHERE EVERY DOLLAR GOES. CREATE YOUR IDEAL SPENDING PLAN AND UNDERSTAND WHY THE PLAN RIGHT FOR YOU.

3

OPTIMIZE YOUR MONEY TO MAKE IT WORK AS HARD AS POSSIBLE FOR YOU. SET UP THE RIGHT ACCOUNTS, THE RIGHT AMOUNTS, AND THE RIGHT INVESTMENTS. HAVE TOTAL CONFIDENCE IN WHAT YOU’RE INVESTING IN AND WHY.

SET YOURSELF UP FOR FUTURE SUCCESS. UNDERSTAND WHEN AND HOW TO MODIFY YOUR PLAN, NOW THAT YOU HAVE ONE.

4

MONEY MUSE

$

MONEY MUSE $

“HI, MY NAME IS MARIA…

And in this video I share my experience working with Stephanie as my money coach for the past five years. I talk about how Stephanie has helped me with budgeting, understanding my values around money, and saving for retirement. I also discuss how her guidance has empowered me, reduced my fear around money, and helped me achieve important financial goals like buying a house.

Stephanie has completely changed my life!”

MONEY MUSE

$

MONEY MUSE $

IGNITE

COURSE MODULE OUTLINE

MODULE 1: CRAFT YOUR VISION

Program Vision

Craft Your Vision

MODULE 2: SPENDING

Spending - Best Practices

Budgets Vs. Spending Plans

MODULE 3: SAVINGS

Emergency Savings

Calculate Your Emergency Savings Fund

MODULE 4: INVESTING

Investing - Little known facts and industry secrets

Your Money and How to Prioritize

MODULE 5: CRAFT YOUR SPENDING PLANS

Your Monthly Spending Plan

Your Lump Sum Spending Plan

MODULE 6: OPEN THE RIGHT ACCOUNTS

Retirement account types

Choosing the right accounts - Everyone

Choosing the right accounts - w2 employees

Choosing the right accounts - Self-Employed

Non-Retirement Investing accounts

Open the Right Accounts

Breaking up with Your Advisor

MODULE 7: INVESTMENT BUILDING BLOCKS

Stocks, Bonds, and Cash

Mutual Funds, Index Funds, and Active Funds

Common Market Sectors and their Returns

Target Date Funds

MODULE 8: INVESTMENT RISK TOLERANCE & ASSET ALLOCATION

Intro to Risk Tolerance

Risk Tolerance Profiles

Your Stock & Bond %

Building Your Portfolio

Choosing Your Funds

MODULE 9: INVEST YOUR MONEY

Manual vs. Automated Investing

Invest Your Money!

MODULE 10: SET YOURSELF UP FOR SUCCESS

Your One Page Plan

Tracking Your Money

Monthly Money Date

Annual Money Check-in

RECENT CLIENT LOVE NOTES

“THANKS TO YOUR PROGRAM I WAS ABLE TO SAVE over 30K IN INVESTMENT FEES THIS YEAR ALONE! AND I WILL HAVE OVER 60K IN INCREASED INVESTMENT RETURNS DUE TO THE CHANGE WE MADE!”

— SUSan, CLIENT

Yay! My YTD 401K rate of return is now almost 12%. Before I started Ignite, it was about 4%.....Huge win!

— Lisa, ignite graduate

“The coursework was so helpful. Easy to understand and fit into your day to day life. I also love all the templates and examples we were given to help us think through our finances one step at a time. The weekly calls are invaluable to hear from others and see what is working for them. 10/10 amazing all around!

I feel so much more confident managing my money. Since starting the course my net-worth has increased 5.3% and I have $59K more than when I started Ignite.”

— stephanie, ignite graduate

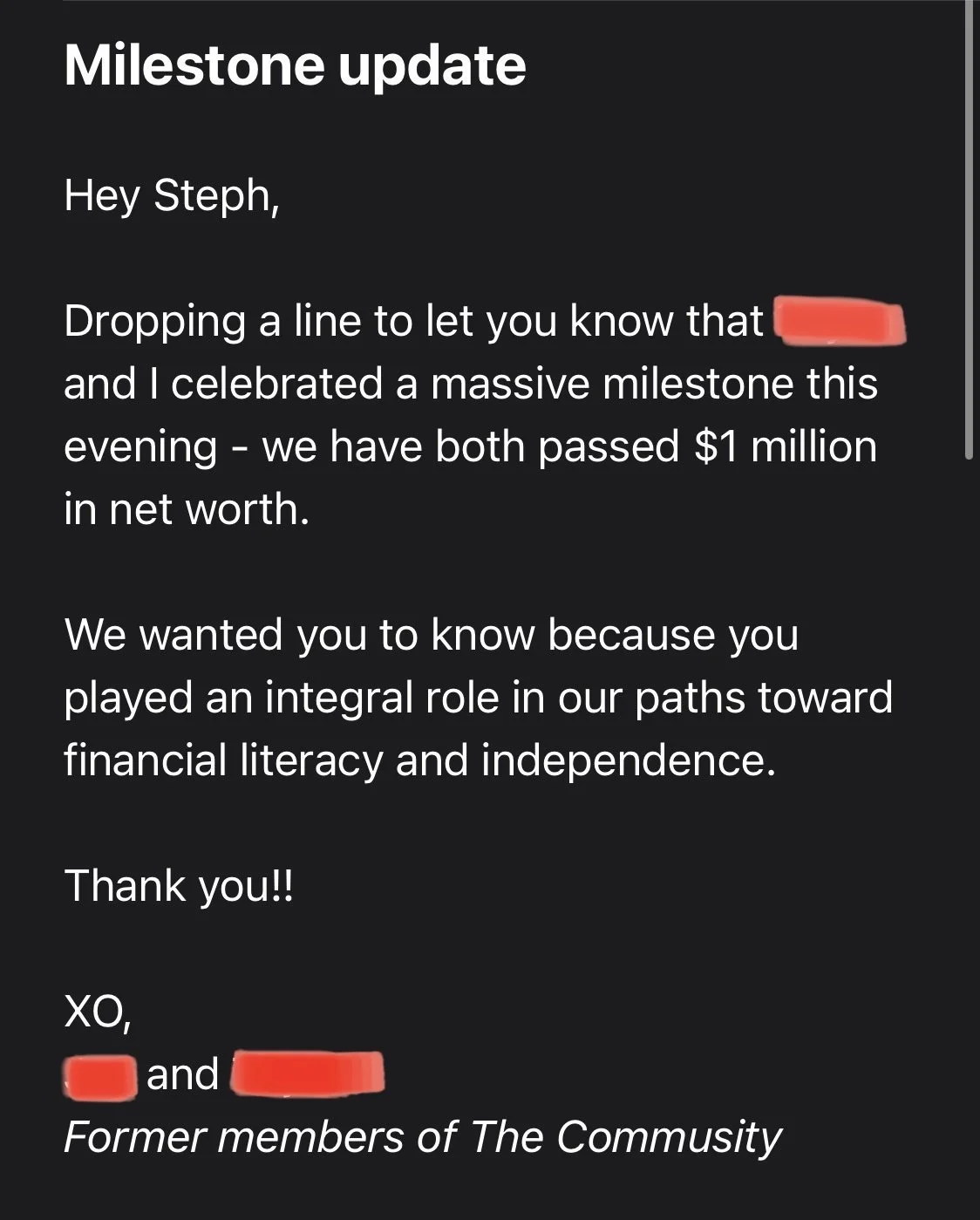

💸 EMAILS FROM TWO CLIENTS WHO RECENTLY JOINED THE MILLIONAIRES CLUB 💸

“I really enjoyed the learning process of investing and being financially responsible with money. It was a game changer learning how simple investing really is.

I fired my financial advisor and within a couple weeks my brokerage account fund went from $50,000 to $80,000. I learned how much of my income to invest and how to save for retirement.”

— samantha, ignite graduate

$

IGNITE

$ IGNITE